Companies Use Job Cost Sheets to Track the Costs of:

Because direct labor tends to be the most significant cost for service companies these companies track costs by job using a timesheet and job cost sheet just as manufacturing. A Direct materials direct labor operating costs.

Learn About Job Cost Sheets Chegg Com

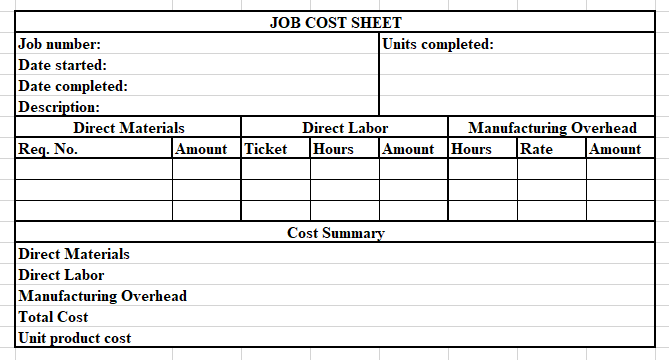

Job cost sheets are used to record the prime costs of each job.

. There are various costing sheet templates available. If the factory overhead is underapplied then the adjusting journal entry to close the. Regardless of whether the service has inventory accounts service companies all keep track of the direct labor and overhead costs incurred while completing each job in progress.

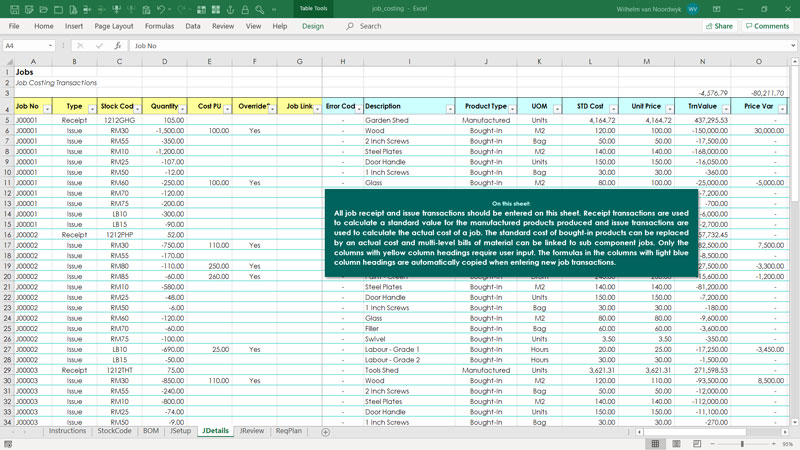

Materials labor and overhead costs of a job. Before initiating any particular segment or assigning any task to an outsourcing agent job costing is a very important and crucial portion. This information system ensures that the company accounts for all direct materials direct labor and overhead costs and accumulates the cost of each job.

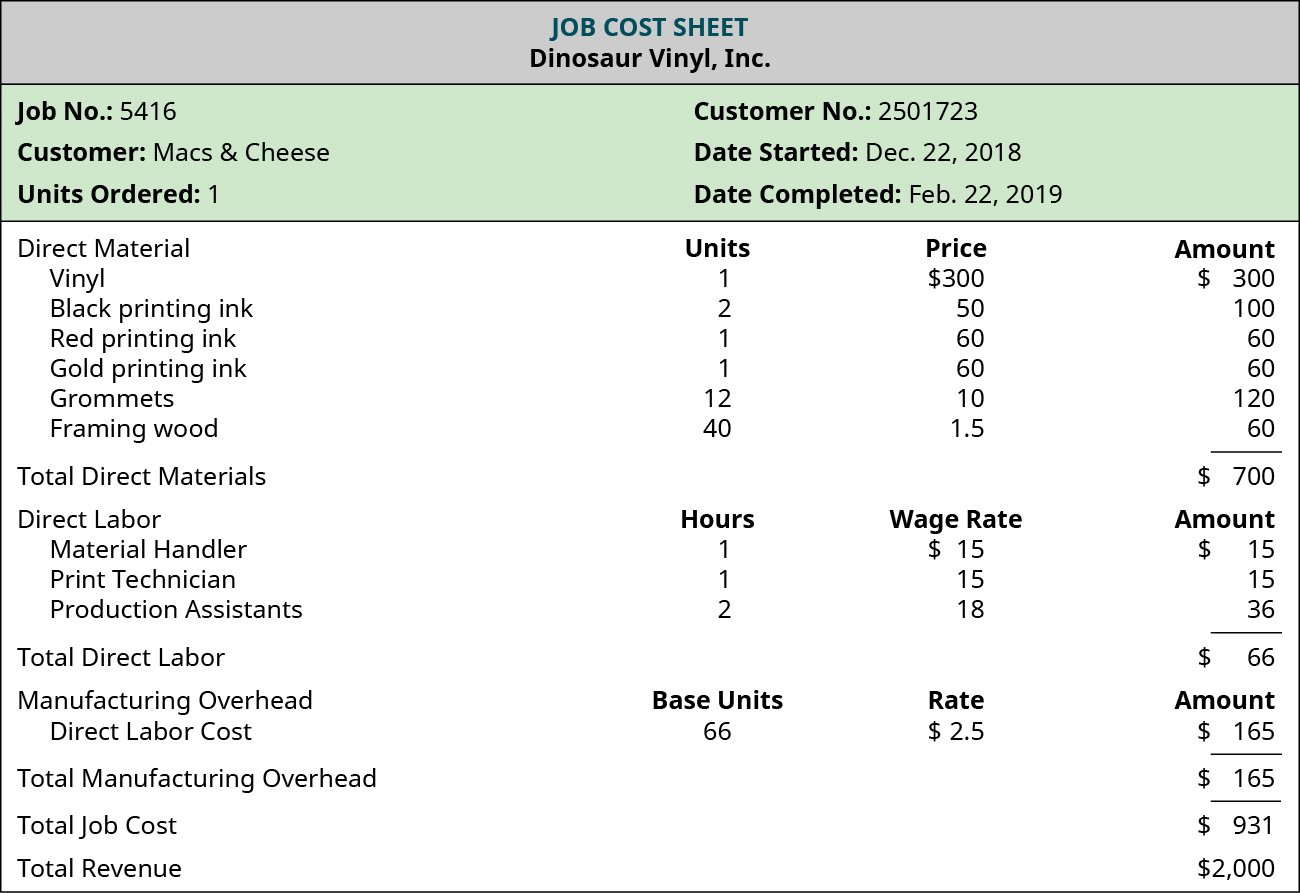

The focus of a job order costing. Companies use job cost sheets to track the costs of. A job order costing system uses a job cost sheet to keep track of individual jobs and the direct materials direct labor and overhead associated with each job.

Companies can use job order costing and process costing to track the cost of products that they manufacture. Materials labor and overhead costs of a job 2. Companies use job cost sheets to track the costs of.

However there are key differences between job order costing. Accounting questions and answers. C Direct labor actual overhead selling costs.

Companies also use these systems to track revenue and the resulting profit for each job. Companies use job cost sheets to track the costs of. B Direct materials estimated overhead administrative costs.

Because direct labor tends to be the most significant cost for service companies these companies track costs by job using a timesheet and job cost sheet just as manufacturing. A job cost sheet includes. A job costing system is used by.

Materials labor and overhead costs of a. A job costing system can. Companies use job cost sheets to track the costs of.

All of the following are inventory accounts for a manufacturer except. A materials labor and selling costs of a job b labor marketing and operating costs of a job c materials labor and. Job cost sheets are used to track all of the costs assigned to a job including direct materials direct labor overhead and all.

Job cost sheet is a document used to record manufacturing costs and is prepared by companies that use job-order costing system to compute and allocate costs to products. A process costing system is used by companies that produce similar or identical units of product in batches employing a consistent process. Job costing systems can do more than simply track the costs of each job.

Job costing is commonly used in the construction industry where costs vary widely from job to job. But its also used by manufacturers creative agencies law firms and.

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

Example Summary Of Cost Flows At Custom Furniture Company Accounting For Managers

No comments for "Companies Use Job Cost Sheets to Track the Costs of:"

Post a Comment